As the energy industry continues to undergo a substantial shift towards sustainable and renewable sources, insurers find themselves navigating new terrain, filled with novel challenges and increased risks. Renewable energy projects, while their benefits are widely apparent, introduce a range of intricate and unfamiliar risks that traditional insurance models may not be equipped to handle.

Weather-related risks

One of the most significant challenges lies in the unpredictability and variability inherent in renewable energy sources. Renewable sources such as wind and solar are subject to the unpredictability of nature. Insurers must account for fluctuations in energy production, which can lead to revenue instability for energy companies.

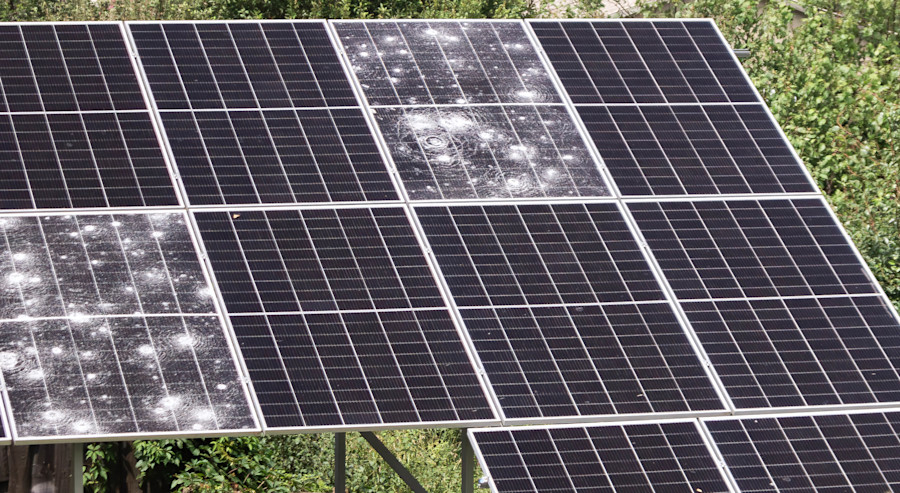

Extreme weather events, such as storms, floods and fires, also pose significant risks to energy transmission infrastructure. Solar panels and wind turbines, often situated in exposed locations, are subject to the elements and inevitably incur wear and tear or, in some cases, substantial damage from adverse weather conditions, leading to costly repairs and interruptions in service. While manufacturers of this infrastructure are consistently working hard to find solutions to remedy these issues, these advancements are costly and are often in unchartered territory, leading to unidentified risks.

The very nature of these events can mean it takes some time before loss adjusters can physically assess the damage, but insurers like Tokio Marine Kiln, are using drones to assess damage during these catastrophic weather events. This can reduce the claim turn around time and costs involved with assessment of the claim.

Further, in response to the unpredictability of the renewable energy, the insurance industry is also looking to parametric policies that offer more dependable and cost-effective coverage, when the 'traditional' insurance policy may not be suitable. Parametric policies aim to indemnify insureds for precise loss, and offer coverage based on pre-defined parameters. Once a claim is triggered, they are settled according to a pre-agreed payout scale which can often lead to faster pay outs.

Lack of historical data

The lack of historical data also adds to the risks faced by insurers. Unlike conventional energy transmission systems which has many decades of historical data to inform decision making, renewable energy systems are relatively new, and evolving at a fast pace.

Insurers, often backed by reinsurers, have extensive expertise in risk modelling and data analytics, which must be used to accurately assess and quantify the risks and uncertainties involved with renewable energy projects. We are already seeing insurers set up sectors to help address the data gaps in the industry, with Swiss Re setting up the Centre of Competence for Renewable Energy, and AXA XL setting up AXA Climate in 2019. It is clear that insurers are well-aware, and have been for some time, of the risks associated with this movement and are urgently transitioning their markets to address these issues.

Changes in technology and the regulatory & compliance standards

While technology advancements are allowing for a smoother transition to renewable energy, it also comes with the costs of advanced regulatory and compliance risks. Insurers must stay abreast of changing regulations and standards to ensure that the renewable energy products they are insuring, comply with these standards. Underwriters in this field are required to upskill and broaden the depth of their knowledge of these new technological advancements.

While it is a complex field that the insurance industry is needing to adapt to, it is also an important for legal professionals and brokers, who often work closely with this industry, to stay up to date on these advancements.

All information on this site is of a general nature only and is not intended to be relied upon as, nor to be a substitute for, specific legal professional advice. No responsibility for the loss occasioned to any person acting on or refraining from action as a result of any material published can be accepted.

Client portal

Client portal